Charitable Capital Planning

Planned Giving Redefined

Turnkey Planned Giving Services For Existing Nonprofit Organizations & Dedicated Causes

Bylaw & Investment Policy Development, Investment Management Outsourcing, Grant Development and Board Development.

Staff Coaching & Training, Marketing & Planned Giving Tools.

The Conversion of Taxable Capital

into

Charitable Capital

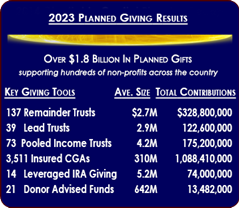

Utilize CharitableCapital Planning To Gain Powerful Results

- Side-step your competition to capture more affluent clients.

- Deal more effectively with client financial life support systems.

- Maintain the "gatekeeper" position your firm already has with clients or rise to that "gatekeeper" position.

- Differentiate your firm in an innovative manner.

- Brand and position as a "financial solutions provider".

- Activate the planning, marketing and technical tooling mandated by today's volatile financial arena.

Complete Implementation and Management Support

Starting At:

$9,499/One-Time

The CharitableCapital Planning Team

Connecting the nonprofit community with the financial services community

- Establishment and implementation of CharitableCapital Giving Programs.

- Provide case design, illustrations, presentations and detailed proposals for the various CharitableCapital planning tools.

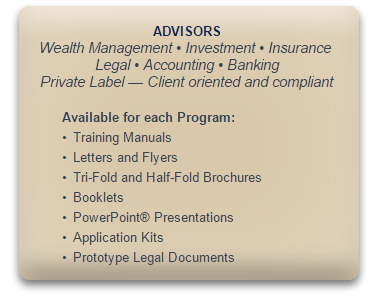

- Custom Designed marketing and educational materials.

- Full color booklets, tri-fold brochures, articles, letters, flyers, envelope stuffers and PowerPoint presentations.

- Training schools and webinars conducted across the country on a regularly scheduled basis as well as custom designed workshops.

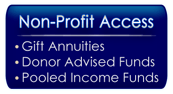

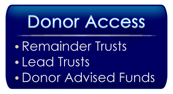

Planning Program Portfolio Overview - Turnkey

All synchronized under the CharitableCapital Planning Program — the third form of financial capital

Each Program includes an assortment of coaching, training, marketing materials, case design and web based calculators coupled with administration and tax reporting to select from.

Administrative Services Overview (services vary by program type)

Compliance

Ongoing support from administration experts will help you keep your programs on track. Self-dealing, step transactions, and miscalculations are just a few of the common oversights that can cause problems.

Tax Reporting

Federal and state charitable tax returns are prepared for signature with plenty of time for review, questions, completion of donor tax returns, and timely filing with the IRS.

Four-Tier Accounting (if required)

Correctly applying the four tier accounting rules are critical. Our administration system tracks and inputs each transaction into all of the appropriate tiers required for proper accounting. On-going four-tier reports are made available through online accounts and Annual Reports.

Annual Reporting

Annual reporting provides a clear and concise performance summary for the year and graphically compares current year valuations to previous year valuations. It also includes an itemized valuation report and a four tier accounting report showing income and expenses for the year.

Questions? Interested in learning more?

Schedule a complimentary brainstorming call today.